Total percentage of taxes taken out of paycheck

Until we reckon with our compounding moral debts. There is no maximum limit on this portion of the tax.

Saltmoney Org Scholarship Infographic Https Www Saltmoney Org Content Media Infographic Are Schol Scholarships For College Scholarships School Scholarship

In the table tax year 1 for example means your first tax year ending on or after the date of the contribution.

. 4 time and savings deposits certificates of deposit and money market accounts. If youre concerned about taxes on your paycheck you may wonder How do I figure out the percentage of taxes taken out of my paycheck There are many factors that affect your pay. Understanding them can also open your mind that they are not just pure deductions but also benefits you from being a US.

How Much Money Gets Taken Out of Your Paycheck. Paycheck the payroll taxes are. How Your Indiana Paycheck Works.

Now were in the 2022 tax year and there are some major differences from 2021. You should receive a Form 1099-R for the year in which the excess deferral is distributed to you. Property taxes and unemployment insurance taxes are levied in every state but there are several states that do without one or more of the major taxes.

That works out to 800 per week 3200 per month and 41600 per year--pretax. With the 2019 tax code 62 of your income goes toward social security and 29 goes toward medicare tax but if youre employed by a company full-time they pay half of your medicare responsibilities so you should only see 145 taken from. Other factors that can affect the size of your paycheck in California or in any other state.

Or if youre paid by the hour you can divide. Youve filed your taxes put away your tax documents and possibly cashed your refund check. In fact the latest statistics show that the number of millionaires in the US has beaten the total populations of Greece Sweden and Portugal.

The employer withholds 7650 from this employees paycheck and sends it to the government. Any income on the excess deferral taken out is taxable in the tax year in which you take it out. The United States added 2251000 new millionaires from 2019 to 2020.

This is money that comes out of your paycheck before income taxes are removed. Thats a staggering sum but it amounts to a true tax rate of only 34. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks.

Lets say you got a new job that pays 20hour. Sixty years of separate but equal. Accounts that take pre-tax money include 401k and 403b plans.

In order to calculate your gross pay divide your total salary by the number of periods you work in a year. Your tax brackets will be slightly higher for example as will your standard deduction. Taxes taken out of paycheck is not the same for every employee.

Social Security tax rate. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. What Small Business Owners Need To Know For Payroll All of the information above can apply to both business owners and employees.

Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. Two hundred fifty years of slavery. For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month.

The 2021 tax season is over. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed.

The corporate income tax the individual income tax or the sales tax. 3 cash and demand deposits. Millionaire Statistics Editors Pick.

2 other real estate owned by the household. The result is that it lowers how much of your pay is actually subject to taxes. The money you contribute to a 401k plan will be deducted before taxes are taken out.

Another useful way to change the size of your paycheck is to make pre-tax contributions. The amounts taken out of your paycheck for social security and medicare are based on set rates. And as frustrating as it can you must get yourself familiar with these taxes to know where those chunks of your income go.

The amount of federal taxes taken out depends on the information you provided on your W-4 form. The total number of millionaires in the US is 2027 million. 5 government bonds corporate bonds foreign bonds and other financial securities.

Use your gross pay your pay before any taxes are taken out for this calculation. Thirty-five years of racist housing policy. 1 the gross value of owner-occupied housing.

Total assets are defined as the sum of. 6 the cash surrender value of life. They paid a total of 136 billion in federal income taxes in those five years the IRS data shows.

NW IR-6526 Washington DC 20224. The absence of a major tax is a common factor among many of the top 10 states. Remember that whenever you start a new job or want to make changes youll need to fill out a new W-4.

Find out whether or not you can opt out of paying Social Security taxes which are typically taken automatically from your paycheck. If you take out part of the excess deferral and the income on it allocate the distribution proportionately between the excess deferral and the income. For example if your employer has a 401k plan and you utilize it your contributions will come directly out of your paycheck.

However if you are self-employed you must pay both the employer and the employee taxes or 124. For example you can have an extra 25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. We welcome your comments about this publication and your suggestions for future editions.

This lowers your taxable income and could be a good way for you to save on your taxes until retirement. This paycheck calculator will help you determine how much your additional withholding should be. The following table shows the percentage of income from the property that you can deduct for each of your tax years ending on or after the date of the contribution.

There may also be contributions toward insurance coverage retirement funds and other optional contributions all of which can lower your final paycheck. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes. In other words if you work for someone else you pay 62 of your income as Social Security taxes and your employer matches this amount.

A separate payroll tax of 145 of an employees income is paid directly by the employer and an additional 145 deducted from the employees paycheck yielding a total tax rate of 290. The other 3240 is taken out of your paycheck for taxes and other deductions such as health insurance and retirement savings. Ninety years of Jim Crow.

The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. That 250 would be pulled for your insurance payment and youd pay taxes.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

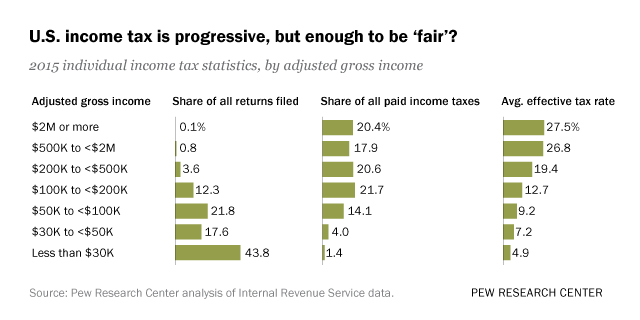

Who Pays U S Income Tax And How Much Pew Research Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Federal State Payroll Tax Rates For Employers

Who Pays U S Income Tax And How Much Pew Research Center

Understanding Your Paycheck

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll Tax Vs Income Tax What S The Difference